The National Health Insurance Fund (NHIF) is dying a natural death; few are even aware it is collapsing under its own weight. NHIF is imploding, but policymakers still believe they can fix the mess that is nibbling it inside out.

National Health Insurance Fund is the outcome of a 1990-1992 study on the long-term options for financing health services in Tanzania. An Act of Parliament established it: Act No. 8 of 1999. The scheme commenced operations on 1st July 2001 when members and their respective employers started contributing. Some of the principles in establishing the NHIF were:-

- Strengthening cost sharing in government health facilities by providing an opportunity for formal sector employees to contribute.

- Providing health insurance to employees in the formal sector, especially after the introduction of user fees.

- Allowing free choice of providers to civil servants — who were previously restricted to government health facilities.

- Enhancing health equity among employees in the health sector.

- Providing an environment for the growth and participation of the private sector.

The scheme is compulsory and covers all public sector employees. However, the Fund covered only Central Government employees in the first two years of operations. In 2002, the membership base was extended to cover all public servants in a move to widen coverage until all formal sector employees were covered. The membership includes principal members, their spouses, and up to four children and/or legal dependants.

Where both a couple (man and woman) are workers in the public service, they have equal rights to register four different children or dependants. The scheme has no option for opting out. The Minister of Health has been empowered under existing legislation to determine any other category of workers to become members of the scheme with a view to enhancing the Fund’s membership. The scheme may eventually include optional members.

Read related: Is healthcare a Human Right or a Privilege?

The NHIF Act section 30 (j) empowers the Board of Directors to review and make some improvements to the benefit package, including a review of the rates used to reimburse the health care providers. At the inception of the scheme, the benefit package included: Registration fees – fixed per visit per level of health facility; Basic diagnostic tests; Outpatient services which include payment of examinations and all drugs prescribed for its beneficiaries in both private and public hospitals, provided that the Fund accredits the hospitals or health facilities. The medication prescribed should be from the list of essential drugs.

The prescriptions should be generic where available. In-patient services include accommodation, medication, examinations, investigations and surgery, which range from minor to super-specialized surgery. The Fund benefit package is progressive and subject to an actuarial assessment that is done every year and the actuarial valuation that is done every three years. The Fund has already increased the benefits offered to beneficiaries and enhanced reimbursement to providers. A referral letter from lower levels is required to access higher-level health facilities.

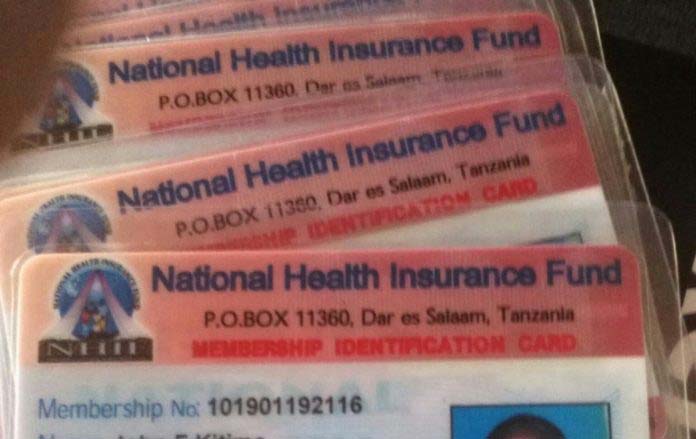

Under section 15 (1) of the NHIF Act, the Fund is obliged to issue an identity card to every registered member. However, for the identity card to be issued, members are required to correctly fill out NHIF registration forms and pass them to the employers for certification before being sent to the Fund offices. Likewise, the Fund is required to produce identity cards and distribute them to employers to be handed over to members.

The Fund devised a special NHIF “sick sheet” to be used with the employers’ identity cards whenever members must access services from accredited health facilities. As of 31st January 2005, the Fund had produced and distributed 946,153 (83.1%) Identity cards out of 1,142,378, which is expected to be produced if all members submit their forms to the Fund offices. No beneficiary can access health care services without the NHIF Identity card.

The contribution rate provided in the Act establishing the Fund is 6% of the monthly employee’s gross salary (met equally by both employer and employee, i.e. 3% each). The Act provides for a penalty of 5% to the Employer who delays remitting contributions to the Fund. Employers must remit contributions to the Accountant General’s Office (Ministry of Finance-Treasury), and then the Ministry of Finance directly pays into the National Health Insurance Fund.

Providers are reimbursed through a fixed fee per service; however, the Fund Administration is expected to gradually move to capitation as the business volume and the benefit package’s complexity increases.

The National Health Insurance Fund (NHIF) Act of 2023

By the time the new NHIF Act of 2023 was being enacted, only 8% of the people were insured. The legislation was overambitious and did not consider the weighty managerial difficulties of running a health scheme that covered employees with assured sources of meeting their contributory obligations. Now, the floundering NHIF has been overburdened with new responsibilities of insuring everyone else with over 80% of new members without a stable income or means of clearing their contributions. The rewritten law was dead, buried and rotting on arrival.

Read related: Insuring Brighter Future: Exploring the Tanzanian Insurance Sector.

Extortionate rates also remind us that our political class is insulated from the harsh realities of their countrymen. The rates to meet NHIF memberships are higher than what an average family spends on health per year. So, sanity demands that enrollment rates be low despite the law commanding everybody who is not a senior citizen of 65 years and above to enrol.

An average family will consider the math and see they are better off without NHIF enrollment, weakening the whole concept behind universal health coverage, which was to lower health costs, widen health access, and crater the poor working conditions of medical workers. The World Health Organization (WHO) estimates an unacceptable ratio of one doctor to 100,000 patients. That rate is unlikely to change under the debilitating law the Parliament has passed.

The new NHIF law was silent in plugging huge leaking holes, as the CAG report (2022) pointed out that NHIF employees had converted the fund into a personal enrichment scheme. The CAG said over Tshs 41 billion was loaned to the NHIF staff, which are the members’ contributions for personal use!

The NHIF modus operandi is aiding in hiking up the rates each member coughs up. The contributions that NHIF employees lend to themselves do not attract commercial interest payments, weakening our banking sector in the process. One thought the Parliament would have closed this spigot that is draining money earmarked to cover health insurance and improve the working conditions of the medical workers.

The CAG report also said that the government has exempted senior citizens from paying NHIF contributions without covering their costs. NHIF pays for them, but the government does not reimburse the NHIF. The NHIF solution has been to ramp up the contribution rates to make ends meet. As the rates keep skyrocketing, it becomes uneconomical to run and sustain, leading to membership compulsion to trudge on. But brute force has its limits, too.

Government employees from BoT, NSSF, TRA, TANAPA, TANROADS, TANESCO, NMB, and others were urgently compelled to join the NHIF. Despite bringing in plenty of cash, NHIF was ill-prepared to accommodate them. These new members had special needs, such as VIP treatment, that demanded time to sort out. The ensuing mess should have led to sanity to prevail, as NHIF has too much on its plate, and universal health insurance was dead on arrival.

The Future of Universal Health Insurance

Well, facts need to be told now without twinkling of an eye. Universal health insurance never worked anywhere so why clamour for an obvious failure? The only thing that works is the creation of dummy government employees pretending to work for the sick while, in reality, they care less about them but their own bellies. The NHIF rates given to health providers are too low to meet minimum costs as a result they are shunning being pushed out of business to prop up a lie.

Every time you hear a mandatory law, just remember that it is fighting the powerful yet hidden hand of the market. Nobody can defeat the market, and we have a litany of experiences from Ujamaa utopia to prick our guilty conscience.

The real solution to medical access and affordability lies in free, government-owned health services. Nobody says anything about the wage bill that NHIF gobbles up every day for interference with market forces. That wage bill should be redirected to free medical services where it matters most.

Market forces have been talking as health service providers are shunning this NHIF titanic, and our beloved minister for health and her assistants are clenching their fists for a fight, threatening those medical providers with consequences that include pecuniary and closures.

These providers have committed an offence by heeding the powerful hand of the market, which is sensible.

Well said. 41 Tshs Billions is something to consider bringing back;