Tanzania has many minerals, including gold, diamonds, coal, iron ore, uranium, and precious stones like Tanzanite, a gemstone found exclusively in the country. As of the latest figures, Mining and quarrying activities significantly contributed to Tanzania’s Gross DomeTanzania’sct (GDP) growth in the first quarter of 2021. The sector recorded 10.2 per cent of the GDP, equivalent to 1,473,804 million TZS.

The activity recorded a growth rate of 9.8% in the third quarter of 2022 compared to a growth rate of 13.1% during the corresponding quarter in 2021.

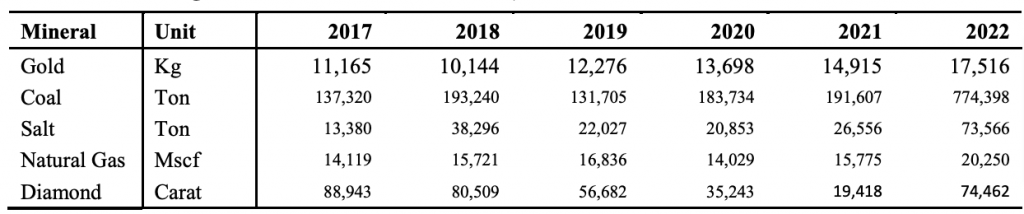

Gold production increased to 17,516 kg in the third quarter of 2022 compared to 14,915 kg produced in the third quarter of 2021, diamond production increased to 74,462 carats from 19,418 carats, and coal increased to 774,398 tons from 191,607 tons.

Tanzania is also home to many rare earth and critical minerals that are currently in the exploration stage. Tanzania earned around 2.3 billion U.S. dollars with minerals exports in 2019, a significant increase over 2018 at 1.6 billion U.S. dollars. Gold had the highest contribution to the value of mineral exports. Tanzania is the 4th largest gold producer in Africa after South Africa, Ghana and Mali and is the world’s sole producer of the world’s precious stone, Tanzanite. Gold production currently stands at roughly 40 tonnes a year, copper at 2980 tonnes, silver at 10 tonnes and diamond at 112,670 carats.

Given the next few years of significant diversification to mining nickel, uranium and coal, the Tanzania mining industry remains attractive to investors. Investment incentives and supply chain opportunities are also available in the mining sector.

Public-Private Partnerships: A Vein of Collaboration in the Mining Sector

The concept of PPP entails an arrangement between the public and private sector entities whereby the private entities renovate, construct, operate, maintain, and manage a facility in whole or in part per output specifications. The private entity assumes the associated risks for a significant period and, in return, receives benefits/financial remunerations according to agreed terms, which can be in the form of tariffs or user charges. PPP is, therefore, a cooperative venture built on the expertise of each partner that best meets clearly defined public needs through the most appropriate allocation of resources, risks and rewards.

Public-Private Partnerships (PPPs) have emerged as a strategic response to the mining sector’s needs. By engaging with private entities, the government leverages the latter’s capital, innovation and management capabilities to fuel growth within the sector.

One of the prime examples of PPPs in action is the collaboration between the government and large mining firms in developing the Tanzania-Zambia railway line (TAZARA), which is pivotal for mineral export. Another is the government’s stake in strategic mining operations, ensuring direct benefits from the profits.

Current State of PPPs in the Mining Sector

The Tanzanian government has increasingly looked to PPPs as a vehicle for growth within the mining industry. These partnerships leverage private sector efficiencies, capital, and expertise to address the developmental, operational, and infrastructure needs that cannot be met by public funding alone. By creating a more inviting investment climate, Tanzania has attracted foreign direct investment, critical to expanding mining operations and improving sector performance.

So Far, What Are the Reforms Made in the Mining Sector?

The Tanzanian government has enacted several legislative reforms to attract foreign direct investment while ensuring the sector is well-regulated and beneficial to the economy.

There have been a few changes in the Mining industry in the country. According to the Petroleum Act, 2015 PDF and the Mining Act 2010 PDF, license holders and contractors in the extractive sector are liable to pay taxes, including corporate tax (30%), capital gain tax (30%), withholding tax (0%) and other taxes. Profits resulting from the transfer or disposal of rights are also subject to taxes, which the Tanzania Revenue Authority collects.

In June 2017, the Tanzanian government passed laws with significant implications for extractive sector governance in the country (including the Natural Wealth and Resources Contracts Bill, the Natural Wealth and Resources Bill and the Written Laws Act). One of the most significant implications of the bills is that they empower the national assembly to allow the government to re-negotiate any inequitable agreement containing “conscionable terms”.

Other provisions entitle the government to stake at least 16 % in mining companies operating in the country, with the option to acquire up to 50%. The Tanzania Extractive Industries Transparency and Accountability Act 2015 PDF has provisions for making all new concessions, contracts, and licenses available to the public.

Read the analysis on Tanzania-Winshear Settlement here; “Tanzania-Winshear Settlement: Did the $30M Payout Signal Desperation or Diplomacy?”

In a significant move reshaping Tanzania’s mining landscape, the recent legislative amendments have culminated in the creation of Twiga Minerals Corporation Limited. This joint venture, a strategic alliance between the Tanzanian Government with a 16% share and Barrick Gold Corporation Company holding the remaining 84%, marks a new era in mining cooperation.

Additionally, in a gesture underscoring its commitment, Barrick Gold Corporation has made an initial payment of $100 million as part of a landmark $300 million settlement agreement. This development signifies a significant milestone in industry relations and heralds a new chapter of collaboration and growth in Tanzania’s prosperous mining sector.

Tanzania Digest would like to take you on the analysis of Twiga Minerals Partnership with the government; read here, “Twiga Minerals: Transforming Tanzania’s Mining Industry through Government Partnership.”

Government Partnership With Australia in Mining and Critical Minerals

Tanzanian mining has navigated many challenges and opportunities in the past ten years. Amidst these trials, Australian mining companies have showcased unwavering commitment and resilience in developing their Tanzanian assets. Their enduring patience and steadfast dedication are now yielding significant gains, marking a triumphant era in the Tanzanian mining landscape.

In January 2020, a groundbreaking deal between the Tanzanian Government and Barrick, Tanzania’s largest mining investor, reshaped the industry’s future. This innovative agreement introduced a novel operational structure for Barrick’s investments, including a framework agreement granting the government a 16% non-dilutable free carried interest. This strategic move created a new model for the sector and launched a dynamic new chapter in Tanzanian mining.

The landscape of Tanzanian mining is witnessing a surge in Australian involvement. Several Australian mining firms, including Black Rock Mining, Strandline, and Orecorp in 2021, followed by Peak Rare Earths, Ecograf, and Evolution Energy Minerals in 2023, have successfully inked framework agreements and solidified shareholding/investment arrangements with the Tanzanian Government. This trend is not just a flurry of isolated deals; negotiations are underway with several more companies, signalling a robust Australian presence and partnership in Tanzania’s mining sector.

WORTH NOTING INSIGHT: List Of Active Mineral Licence With Framework Agreement With The Government Of Tanzania

- North Mara Gold Mine Limited, wholly owned 100%, is in a joint venture with Twiga Minerals Corporation Limited in Mara, Tarime.

- In a joint venture named Twiga Minerals Corporation Limited, Bulyanhulu Gold Mine Limited holds a 100% share, with operations in Shinyanga, Kahama, and Geita, Nyang’wale.

- Pangea Minerals Limited (100%) is in a joint venture named Twiga Minerals Corporation Limited in Shinyanga, Kahama.

- Williamson Diamonds Limited (100%) is located in Shinyanga, Kishapu.

- The joint venture of Kabanga Nickel Company Limited and Tembo Nickel Corporation Limited operates within Kagera, Ngara.

- In Mwanza’s Sengerema region, the 100% owned joint venture Sotta Mining Corporation Limited represents Nyanzaga Mining Company Limited’s interests.

- Mahenge Resources Limited’s joint venture, Faru Graphite Corporation Limited, operates in Morogoro, Ulanga.

- Mamba Minerals Corporation Limited, operating under Peak Rare Earth Limited, is strategically located in Ngualla, Songwe.

- Strategically based in Temeke, Dar es Salaam, Nyati Mineral Sand Limited operates prominently in the region.

- Ngwena Tanzania Limited’s joint venture, Kudu Graphite Limited, is operational in Chilalo, Ruangwa.

- In Epanko, Ulanga, Tanzgraphite (TZ) Limited’s joint venture, Duma TanzGraphite, is making significant strides.

Brace for the Exciting Future in Graphite Production

Tanzania is rapidly emerging as a global powerhouse in critical minerals, primarily driven by the influx of companies specializing in graphite and rare earths. This strategic focus will propel the country to remarkable heights in mining. Predictions suggest that, based on the momentum of these projects, Tanzania is on track to become the world’s second-largest graphite producer by 2028, positioning it just behind the current leader, China. This ascent highlights Tanzania’s rich mineral resources and underscores its growing significance in the global critical minerals market.

Are you curious about Graphite production trends in Tanzania? Read our latest insight, “Tanzania’s Graphite: The Investment and Geopolitical Landscape.”

A Historic $25M Mining Project Financing

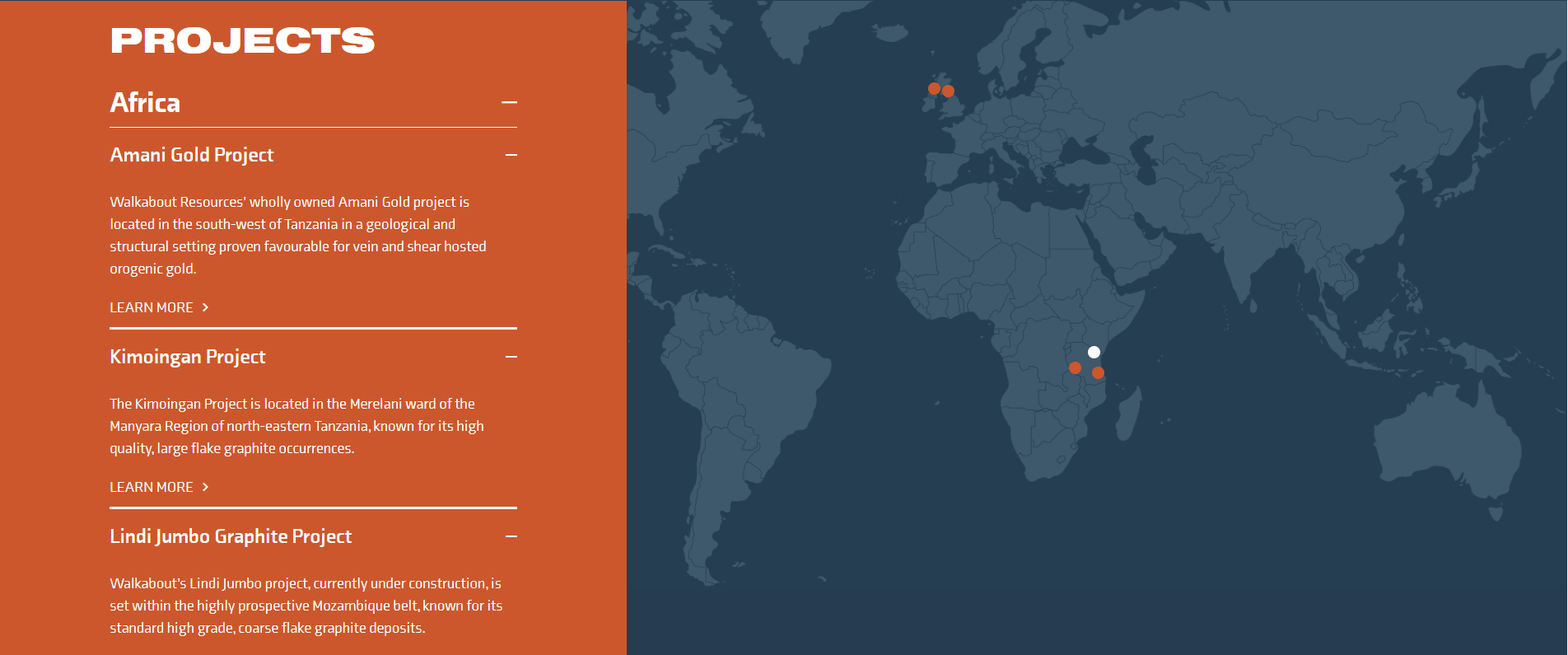

Bowmans Law (a firm that helps clients manage legal complexity and unlock opportunity in Africa, with an enviable track record of providing legal services to the highest professional standards in Africa, regulatory matters and dispute resolution in Tanzania and the wider East African region) has successfully advised Walkabout Resources plc, an ASX-listed, Australian-owned energy minerals developer, producing graphite, gold, base metals and lithium-based in Tanzania, an Australian company with a Tanzanian graphite asset on securing a landmark USD 25 million debt financing.

It is dedicated to constructing its high-grade, high-margin Lindi Jumbo graphite project in Tanzania. Cited as the second-highest margin graphite project globally (Benchmark Minerals, 2019).

This funding, sourced from the City of London, marks the first international debt financing for a Tanzanian mining project in over 15 years. Though modest, it’s significant for the industry, enabling Walkabout to complete its Southern Tanzania mine. This mine, set to begin production soon, will be Tanzania’s first major mining project in nearly two decades.