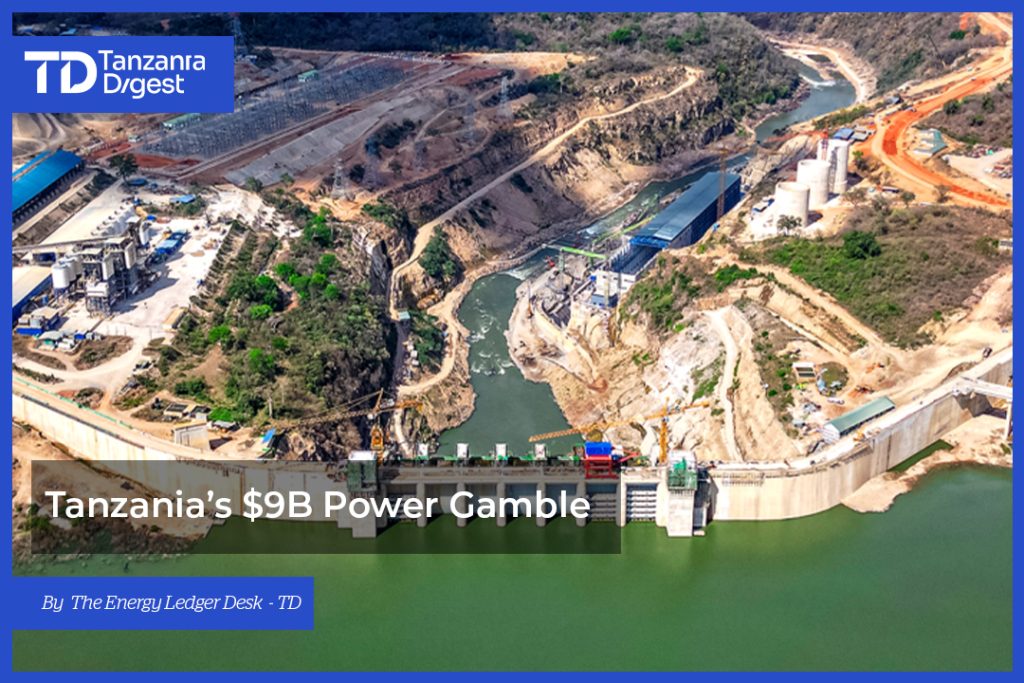

Every budget cycle tells a story. Most years, the tale is about balancing many small needs with limited means, funding for schools, hospitals, rural roads, and water projects. But in recent years, one budget line has towered above all others: the Julius Nyerere Hydropower Plant (JNHP).

From its first allocation to the final payments, JNHP has commanded unprecedented fiscal space. The official price tag of US$2.9 billion made it the most significant infrastructure investment in Tanzania’s modern history. The government proudly announced that over 99.5% of the project’s Sh6.5 trillion funding had been paid by early 2025, primarily from domestic revenue.

This financing model is unusual in Africa. Most mega-projects of this scale lean heavily on external loans from multilateral institutions or bilateral partners. Tanzania’s choice to rely almost entirely on domestic funds was a deliberate political and economic signal: we would build our flagship power project without surrendering control to foreign lenders.

But while that choice avoided external debt burdens, it also meant concentrating a considerable portion of national fiscal capacity in a single project. This raises a bigger question, one that can’t be answered by construction milestones alone: what does this decision mean for the country’s financial health, opportunity costs, and future growth?

The Official Story

The government’s narrative is straightforward. JNHP was budgeted at US$2.9 billion, and the bulk of this came from domestic allocations spread across several fiscal years. This approach allowed Tanzania to avoid heavy interest obligations and the conditionalities often attached to international loans.

From a perspective of fiscal sovereignty, this was a victory. Funding locally ensured that every shilling spent was under Tanzanian control, from contractor selection to payment schedules. It also supported a broader policy stance of reducing reliance on external finance and preserving political flexibility.

However, the official figure only captures the core engineering and construction costs. As with any major capital asset, there are related expenditures that are not always included in headline budgets:

- Transmission line extensions are being implemented to integrate the new power into the grid.

- Environmental mitigation and resettlement costs.

- Inflationary pressures and procurement variations over the multi-year construction period.

These elements are essential to understanding the project’s actual fiscal footprint.

The Real Bill Beyond the Headline

Independent analysts and sector studies place JNHP’s all-in cost between US$7.6 billion and US$9.85 billion once you factor in:

- Environmental impact mitigation in the Selous Game Reserve.

- Resettlement and compensation for affected communities.

- Interest during construction (even if domestically financed, this still reflects lost returns from alternative uses of those funds).

- Transmission infrastructure to move power from Rufiji to industrial and urban demand centers.

On a cost per megawatt basis, this places JNHP in the upper range of global hydropower projects, significantly higher than some gas or solar alternatives that Tanzania could have pursued in parallel.

For public finance, this means the project’s fiscal impact is closer to three times the official number. And because the financing was domestic, the pressure was absorbed directly by the national budget, crowding out other capital spending. In the short term, this likely slowed investments in rural electrification, healthcare facilities, and other infrastructure priorities.

The truth, then, is that JNHP was not just an engineering project; it was a macroeconomic choice. And like all big bets, it will only pay off if the returns outstrip the opportunity costs.

Opportunity Costs

In public finance, every large expenditure is accompanied by a silent shadow — the projects and programs that were not funded because the money was allocated elsewhere. For JNHP, the opportunity cost is immense.

If the all-in cost indeed approaches US$7–9 billion, that amount could have financed:

- A diversified renewable portfolio: At current prices, Tanzania could have built over 3,000 MW of utility-scale solar and wind farms, reducing climate risk exposure while improving geographic supply resilience.

- Nationwide rural electrification: Extending the grid and off-grid solutions to nearly every rural household, accelerating rural industrialization and social equity.

- Health and education infrastructure: Hundreds of modern hospitals, thousands of classrooms, and a significant expansion of vocational training centers.

- Transport network upgrades: Strategic road and port investments to lower logistics costs for exporters and local businesses.

This is not to say that JNHP was the wrong choice; instead, it was a choice that displaced many other potentially high-return investments. When one project dominates national capital spending for years, the bar for its economic payoff must be set much higher.

Impact on Public Finances

Tanzania’s debt-to-GDP ratio stood at around 46% in 2024/25, up from 43.6% in 2021/22. While still within moderate debt distress thresholds according to IMF and World Bank assessments, the upward trend reflects an economy under increasing fiscal pressure.

As of March 2025:

- Total public debt: TZS 107.7 trillion (~US$42 billion).

- External debt: TZS 70.94 trillion (~66% of total).

- Domestic debt: TZS 34.76 trillion (~32% of total).

Debt servicing is a growing burden. In FY2025/26, Tanzania is projected to allocate TZS 14.22 trillion to service debt, a significant share of the national budget. While JNHP avoided new external debt, its domestic financing still carried a cost: the government had to reallocate funds from other capital and recurrent budgets, and in some years, increase domestic borrowing to maintain cash flow.

This approach shielded Tanzania from foreign exchange risk. However, it increased the fiscal concentration risk —the risk that too much capital was invested in a single asset —thereby limiting flexibility in addressing other development needs.

The Payback Question

The return on investment for JNHP will hinge on three critical factors:

1. Industrial Productivity Gains

If cheap, reliable electricity can lower production costs, attract new investors, and boost exports, the project will repay itself many times over. This requires rapid buildout of transmission infrastructure to connect industries to the grid.

2. Energy Export Revenues

Tanzania has the potential to export surplus electricity to neighbors in the EAC and SADC. However, this depends on building cross-border transmission lines and negotiating favorable long-term contracts.

3. Avoided Costs of Thermal Generation

Replacing expensive diesel power generation with hydropower could save millions annually in fuel imports, strengthening the trade balance.

Under optimistic projections, robust industrial growth, strong export agreements, and efficient operation, JNHP could recoup its total cost in 15–20 years through combined domestic and export revenues. Under more cautious scenarios, where demand growth lags or tariffs remain politically constrained, the payback period could extend far longer, risking an underperforming asset.

Governance & Transparency Imperatives

Mega-projects on this scale do not end when construction crews leave. They require decades of operational management, and without strong oversight, financial performance can easily fall short of expectations.

For JNHP, three governance priorities stand out:

- Independent Audits

Annual technical and financial audits should be made public. This is not just an accountability measure; it also builds investor confidence in Tanzania’s capacity to manage large assets. - Transparent Procurement and Contracts

While the project is operational, ongoing contracts for maintenance, transmission buildout, and environmental mitigation will continue. Making these details public helps prevent cost creep and strengthens public trust. - Performance Metrics and Public Reporting

Regular reporting on power output, transmission connectivity, tariff impacts, and environmental compliance will allow the public and investors to track whether JNHP is delivering on its promises.

Without these governance pillars, even the best-engineered project can become a fiscal burden. With them, JNHP can remain a productive national asset for decades.

A Bill to Remember

In fiscal terms, JNHP is more than a line item; it’s a statement of national priorities. The decision to fund it almost entirely from domestic resources was bold, avoiding external debt but concentrating fiscal power in a single, high-stakes project.

If the electricity it generates fuels industrial growth, powers exports, and lowers the cost of doing business, JNHP will justify its place as a turning point in Tanzania’s economic history. But if demand growth lags, tariffs remain politically constrained, or environmental trade-offs go unmanaged, it could become a cautionary tale of ambition without balance.

As a finance professional, I see the lesson clearly: the measure of a project like JNHP is not only the cost per megawatt built, but the value per megawatt delivered to the economy over its lifetime. That value will depend on disciplined governance, forward-looking industrial policy, and the political will to treat JNHP not just as a monument, but as an engine that must run at full capacity for decades to come.

The dam is built. The bill is paid. The real work, making it pay off, begins now.

Exact and very founded Analysis! In .most large international Projects the real Overall costs are Not published, but must be known before start of bidings and contracts. Example: The second largest Hydropower Project in Africa needs of cause overhead Power Transmission lines ! In this Dam Location they are long and expensive. !