Tanzania’s recent ban on non-citizens operating 15 categories of small businesses—effective July 28, 2025—reflects a contentious blend of economic protectionism and political strategy ahead of October elections. Below is a detailed analysis of the policy, its motivations, and implications:

Election-Driven Xenophobia? Tanzania’s High-Stakes Gamble to Secure Local Jobs.

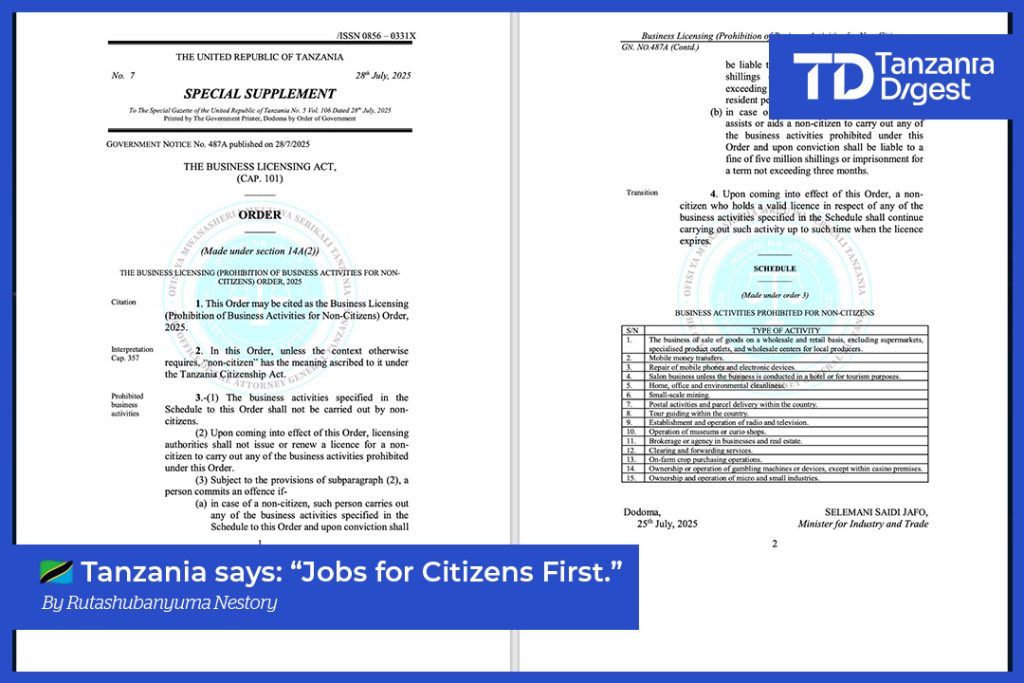

⚖️ 1. Scope of the Ban.

– Prohibited Sectors:

Foreigners are barred from 15 business types, including mobile money transfers, phone repairs, salons (except in hotels/tourism), tour guiding, small-scale mining, on-farm crop buying, radio/TV operations, and micro-industries.

– Wholesale/Retail Exceptions:

Supermarkets, specialized product outlets, and wholesale centers serving local producers remain accessible.

– Penalties:

Violators face fines up to TZS 10 million ($3,900), six-month jail terms, visa revocation, and deportation. Tanzanians aiding foreigners risk fines/jail.

🏛️ 2. Government Rationale.

– Citizen Economic Empowerment:

Officials argue foreigners dominate informal sectors (e.g., Dar es Salaam’s Kariakoo market), undercutting locals through unfair competition or informal operations.

– Redirecting Foreign Investment:

The state aims to push foreigners toward large-scale, formal investments via the Tanzania Investment and Special Economic Zones Authority (TISEZA).

– Broader Economic Nationalism:

This follows a May 2025 ban on foreign currencies for domestic transactions, emphasizing shilling use.

⚡ 3. Domestic and International Reactions.

– Local Support:

Traders’ associations (e.g., Kariakoo) and industry groups applaud the move, citing regained economic control and job protection.

– Kenyan Backlash:

With ~40,000 Kenyans in Tanzania, Kenya condemns the ban as violating East African Community (EAC) free-movement agreements. Threats of reciprocal restrictions loom.

– Regional Tensions:

EAC members (Rwanda, Uganda, etc.) fear disrupted integration and tit-for-tat policies.

📊 4. Election Timing and Criticism.

– Pre-Election Populism:

The ban precedes Tanzania’s October 2025 general elections, where the ruling CCM party faces pressure over unemployment. Critics label it “xenophobic appeasement“.

– Contradictions:

While protecting small traders, the policy clashes with labor reforms favoring foreign investors (e.g., streamlined work permits for multi-company engagement).

💡 5. Ambiguities and Long-Term Risks.

– Legal Gray Areas:

The order targets natural persons, but foreign-owned companies may face de facto restrictions based on regulatory interpretations.

– Economic Fallout:

Reduced foreign participation could stifle innovation in sectors like mobile money or tourism. Regional trade fragmentation may escalate.

– Labor Law Links:

Recent amendments cap unfair dismissal compensation (up to 24 months’ salary) and refine work permits—aligning with broader labor-market controls.

Table: Key Business Restrictions and Exceptions.

| No. | Prohibited Activities. | Exceptions. | Rationale. |

| 1.0 | Mobile money transfers. | None. | Protect local informal finance. |

| 2.0 | Salons. | Hotels/tourism-linked operations. | Shield grassroots beauty services. |

| 3.0 | Tour guiding. | None. | Reserve tourism jobs for citizens. |

| 4.0 | Retail shops. | Supermarkets, specialized wholesalers. | Curb foreign dominance in markets. |

| 5.0 | Small-scale mining. | None. | Secure artisanal mining livelihoods. |

| 6.0 | Radio/TV operations. | None. | Nationalize media control. |

Conclusion:

Tanzania’s ban prioritizes short-term political gains and local job preservation but risks violating EAC treaties, inviting retaliation, and deterring foreign investment. Its alignment with labor reforms suggests a coordinated economic indigenization strategy, yet enforcement challenges and regional fallout could undermine long-term stability. The policy’s success hinges on balancing citizen empowerment with Tanzania’s regional commitments—a test for the post-election landscape.

What is the estimated number of jobs involved?

While “no precise numerical estimate” of jobs directly affected by Tanzania’s ban on foreigners in small businesses is provided, contextual evidence allows for reasonable projections:

🔢 1. Scale of Informal Sector Employment.

– Tanzania’s informal sector employs ”71.8% of the workforce” (25.95 million workers), while the formal sector employs 28.2% (10.17 million workers).

– “Small businesses” dominate the informal economy, constituting “44% of informal employment”. The banned sectors (e.g., retail, salons, mobile repair) fall primarily within this category.

👥 2. Foreign Participation in Targeted Sectors.

– Foreigners operate in “15 prohibited sectors”, including retail, mobile money, tour guiding, and small-scale mining.

– In urban hubs like “Dar es Salaam’s Kariakoo market”, foreign traders (notably Chinese) have increasingly dominated small retail and wholesale businesses, prompting local protests over “unfair competition“.

– A 2025 crackdown in Kariakoo alone led to “7,900 arrests” of foreigners lacking permits, with “4,796 deported”, indicating significant foreign presence.

🌍 3. Regional Workforce Impact.

– Kenya:

At least “40,000 Kenyans” work in Tanzania, many in informal trades now banned. Kenya has threatened reciprocal restrictions, implying these jobs are economically significant.

– Other EAC nations:

Rwanda, Uganda, DRC, and others also have citizens affected, though numbers are unspecified.

⚖️ 4. Policy Goals vs. Practical Uncertainties.

– The government claims the ban will “protect livelihoods” and create space for ”Tanzanian job seekers”.

However:

– “No data” confirms how many jobs will actually transfer to locals versus disappear due to reduced investment.

– Enforcement challenges:

Foreigners often use local proxies, complicating job reallocation.

– Regional retaliation:

Kenyan threats to expel Tanzanian miners could “offset domestic job gains”.

💎 Key Takeaway.

The ban likely affects “thousands of foreign-run businesses” and “tens of thousands of jobs”, primarily in Tanzania’s vast informal sector. However, the net impact on “citizen employment” remains unclear due to enforcement gaps and potential trade disruptions. For precise figures, government disclosures of foreign business registrations in prohibited sectors would be needed.

Can Affected Countries Impose Reciprocal Measures?

Yes, “affected countries can legally impose reciprocal measures” against Tanzania’s business ban under regional and international frameworks, though such actions would carry significant economic and political risks. Here’s a breakdown of the legal avenues, precedents, and practical constraints:

⚖️ Legal Basis for Reciprocity.

1. East African Community (EAC) Treaty Violations.

Tanzania’s ban directly conflicts with:

– EAC Common Market Protocol (2010):

Guarantees free movement of labor (Article 7) and the “right of establishment” (Article 10), allowing citizens of partner states (Kenya, Uganda, etc.) to operate businesses across borders.

– Non-Discrimination Principle:

The ban targets non-citizens, disproportionately affecting EAC nationals. A 2021 EAC Court ruling (“Ssebagala v. Tanzania”) affirmed that such nationality-based restrictions violate treaty obligations.

2. WTO Rules.

While Tanzania invoked “public morals” (GATT Article XX) to justify the ban, affected countries could argue:

– Violation of Most-Favored-Nation (MFN) Treatment:

Discriminating against foreign service providers breaches the General Agreement on Trade in Services (GATS).

– Trade-Restrictive Measures:

Reciprocity could be framed as a proportionate response under WTO dispute settlement.

🌍 Likely Reciprocal Measures & Feasibility.

| No. | Country. | Possible Measures. | Feasibility. |

| 1.0 | Kenya. | Ban Tanzanians from retail, transport, or hospitality sectors.<br>- Restrict visa issuance. | High: 40,000+ Kenyans affected; strong public/political pressure. |

| 2.0 | Rwanda/Uganda. | Retaliatory business licensing restrictions.<br>- Border delays for Tanzanian goods. | Medium: Smaller diaspora impact but strategic interests in EAC unity. |

| 3.0 | Collective EAC. | – Challenge in EAC Court of Justice.<br>- Suspend Tanzania’s EAC benefits (e.g., tariff exemptions). | Low: Requires consensus; political divisions weaken cohesion. |

⚠️ Key Risks of Escalation.

1. Economic Harm:

– Tanzania relies on EAC neighbors for 22% of exports ($2.1B/year). Retaliation could disrupt critical trade corridors (e.g., Kenyan ports handling 75% of Tanzania’s transit goods).

– Job Losses:

500,000+ East Africans work across EAC borders. Tit-for-tat bans could displace workers region-wide.

2. EAC Fragmentation:

– Precedents like Rwanda-Uganda border closures (2019–2022) show how trade spats can escalate into lasting divisions.

3. Investor Flight:

Reciprocal barriers would signal regulatory instability, deterring foreign investment across East Africa.

💡 Diplomatic Alternatives.

Affected countries may prioritize:

1. EAC Mediation:

Petition the EAC Council of Ministers for emergency talks.

2. WTO Dispute:

Initiate formal consultations (lengthy but legally robust).

3. Bilateral Negotiations:

Offer Tanzania concessions (e.g., joint job-creation programs) in exchange for sector-specific exemptions.

Conclusion: Domestic Jobs vs. EAC Unity: Tanzania’s Foreign Business Ban Triggers Reciprocal Threat Cycle.

Reciprocal measures are “legally justifiable but economically perilous”. While Kenya is most likely to retaliate, a full-blown trade war would harm all EAC economies. Diplomatic pressure and legal challenges offer safer paths to reverse Tanzania’s policy—but require swift, coordinated action before the ban’s economic damage becomes entrenched.

Quote:

“Tanzania’s Citizenship-Based Business Ban: Violating EAC Treaties and Inviting Retaliation.”

Read more analysis by Rutashubanyuma Nestory