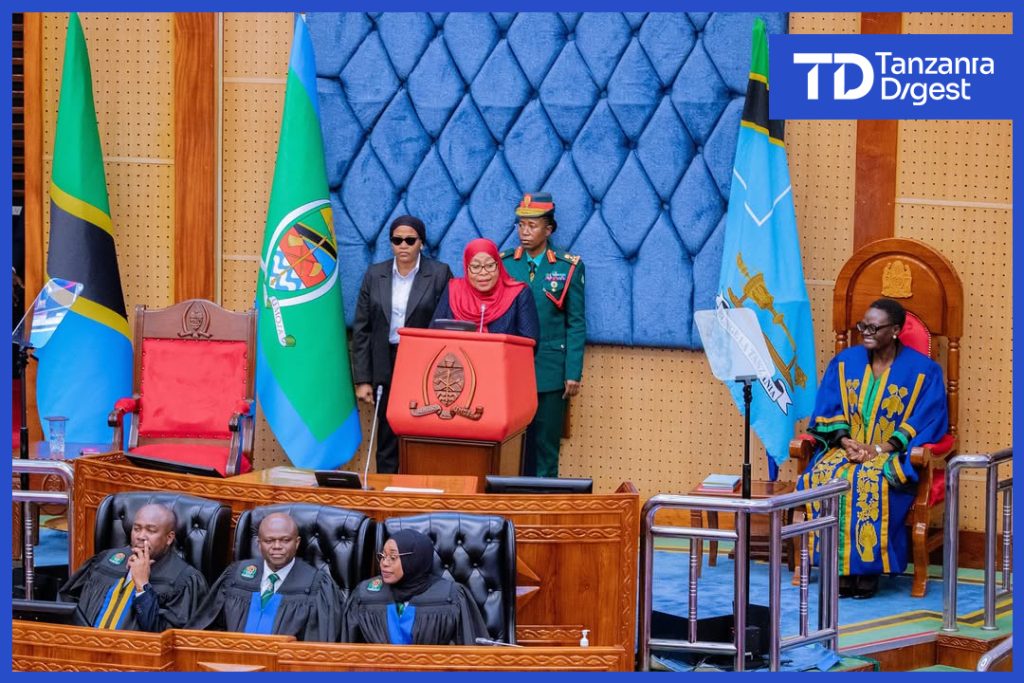

Tanzania Parliament will dissolve on 3rd August 2025. However, the speech that President Samia Suluhu Hassan gave had many meat and bones to digest.

There were encomiums of achievements and promises to achieve even amore. Areas of interest that this discourse will dive in are mainly two: The promise of a constitutional reengineering must be applauded by all albeit I must acknowledge that it will be a path littered with booby traps.

Second was the never ending debate of the impact of the value of local currency in the magnitude of debt. President Samia claimed credit on both sides of the aisles bit the reality isn’t on her side. I shall interrogate whether the value of our currency may be performing well yet still be a drag to a national debt. The math will speak for themselves.

Third, there was absence of conventional denominations raising serious concerns whether the clergy and the government have parted ways foe good.

The triumvirate issues will be serialised in different articles to reduce the prolix involved.

Here we go:

THE NEVER-ENDING DEBATE OF THE IMPACT OF THE VALUE OF LOCAL CURRENCY TO NATIONAL DEBT.

President Samia Suluhu Hassan quickly claimed credit for a well performing local currency against major currencies at the same time she blamed devaluation of local currency to prevent her government from shouldering a ballooning national debt.

In the near past, her assistants in the government have been reproducing irrelevant economic data to extricate themselves that the national debt was bearable. Industrialized nations’ debt to GDP have been weaponized to justify our runaway national debt. In Kiswahili they shouted to us:

“Mzigo wa deni la taifa unabebeka…kwani uwiano wa deni la taifa kwa GDP liko chini sana ya nchi zilizoendelea.”

The killer assumption of this kind if myopic reasoning is Industriliazed nations have a well synchronized capability of squeezing their GDPs to bankroll their national budgets. We have no such clout over our GDP. In other words, until a day comes economy is available to economic extraction to a level of Industrialized nations Tanzania ought not to apply misleading economic indicators. Below is a quantitative analysis relevant to the discussion.

Comparative Analysis: Tanzania vs. G7 Nations in Fiscal Capacity and Debt Sustainability.

1. GDP Utilization for Budget Support: Real Values and Percentages.

Tanzania’s Fiscal Profile:

– Tax Revenue:

13% of GDP (2024), significantly below the Sub-Saharan African average of 16–18%.

– Government Expenditure:

18.82% of GDP (2023), with deficits at -3.63% of GDP.

– Debt Servicing:

40% of government expenditures allocated to external debt repayment.

– Informal Economy Impact:

~50% of economic activity is informal, shielding ~$22 billion (2023) from taxation.

G7 Nations’ Fiscal Profile:

– Tax Revenue:

30–50% of GDP (e.g., Germany: 46.17%, USA: 31.92%).

– Government Expenditure:

37–57% of GDP (e.g., France: 57.24%, Canada: 43.26%).

– Debt Servicing:

Lower relative burden due to higher revenue; e.g., US debt is 120.79% of GDP but supported by deep capital markets.

Key Disparities:

Table: Fiscal efficiency comparison. Tanzania’s revenue-to-debt ratio highlights constrained debt-bearing capacity.

| No. | Metric. | Tanzania. | G7 Average. |

| 1.0 | Tax Revenue (% GDP). | 13% | 35–50%. |

| 2.0 | Expenditure (% GDP). | 18.82%. | 40–55%. |

| 3.0 | Debt-to-GDP. | 47.4% (2023). | 100–150%. |

| 4.0 | Revenue-to-Debt Ratio. | 27.4%. | 70–90%. |

2. Debt-to-GDP Ratio: Suitability for Tanzania.

Limitations of Debt-to-GDP in Developing Economies:

– Inaccessible GDP:

~50% of Tanzania’s GDP is informal (e.g., subsistence farming, unregistered SMEs), reducing taxable revenue. Only 25% of GDP is monetized for fiscal use.

.

– Revenue Volatility:

Heavy reliance on agriculture (25% of GDP) exposes budgets to climate shocks, unlike G7’s diversified tax bases.

– Debt Cost:

Tanzania pays higher interest rates (e.g., 6% key rate vs. US 4.25%), amplifying refinancing risks.

Why G7 Metrics Diverge:

– Formal economies enable efficient tax collection (e.g., US tax revenue: $5.4 trillion vs. Tanzania’s $12.88 billion).

– Central bank credibility allows debt monetization without currency crises.

3. Alternative Debt Sustainability Metrics for Tanzania.

– Revenue-to-Debt Ratio:

Tanzania’s 27.4% (2023) is critical vs. G7’s >70%. A threshold of 200–250% is safer for low-income nations.

– Primary Balance Adjustment:

Requires narrowing the deficit (-3.63%) via digital tax reforms to capture informal activity.

– Human Capital Investment:

Boosting education (13.7% of budget) and health (5.14%) to formalize labor and expand the tax base long-term.

4. Strategic Recommendations.

– Short-Term:

Leverage PPPs for infrastructure (e.g., $3.7 trillion needed by 2050) to avoid debt accumulation.

– Medium-Term:

Adopt “Revenue-to-GDP targets” (e.g., 18% by 2030) and digital payment systems to formalize the economy.

– Long-Term:

Align with Tanzania’s Vision 2050: 6% annual growth via private investment in agribusiness and manufacturing.

Notables.

Tanzania’s constrained fiscal space (13% tax revenue/GDP) and large informal economy render conventional “debt-to-GDP ratios inadequate” for debt sustainability assessments.

Prioritizing “revenue-focused metrics” and formalization is essential to avoid debt distress. G7-like debt tolerance is unattainable without structural shifts toward inclusive growth and digital fiscal innovation.

President Samia made a case that Tanzania’s shilling fared better during her watch but contributed to burgeoning national debt.

The facts indicate if Tanzania’s shilling is doing well against major currencies then due to that alone the national dent ought to constrict, not ballooning as in case in Tanzania.

President Samia Suluhu Hassan cannot have it both ways. Either local currency tumbled as a result it magnified the national debt or it appreciated and dwarfed the national debt.

How did Tanzania local shilling performed against major currencies and how that impacted on the value of national debt in Tanzania shillings?

Analysis of Tanzania’s Shilling Performance and Its Impact on National Debt.

1. Performance of the Tanzanian Shilling Against Major Currencies.

– Depreciation Trend:

– The shilling weakened from “TZS 2,298.5/USD in March 2021” to “TZS 2,650/USD in March 2025”, a “15.3% depreciation” over four years. By June 2025, it traded at “TZS 2,637/USD”, with a “3.9% year-on-year decline” as of April 2025.

– In early 2025, the shilling was labeled the “world’s worst-performing currency, depreciating “8.9%” due to surging imports and infrastructure-linked debt.

– Volatility and Central Bank Response:

– The Bank of Tanzania (BoT) noted short-term fluctuations, including a “9.51% appreciation” in late 2024 (due to seasonal export inflows) followed by a sharp reversal in 2025.

– BoT intervened by selling “USD 7 million” in January 2025 to stabilize the currency, but market transactions plummeted by “83%” month-on-month, indicating severe liquidity constraints.

2. Impact on National Debt Valuation.

– Exchange Rate Effect on External Debt:

– Tanzania’s external debt is “67.7% USD-denominated” (USD 23.1 billion of USD 34.1 billion). The shilling’s depreciation directly inflated the debt value in local currency:

– Example:

A USD 1 billion debt cost “TZS 2.3 trillion” in 2021 but “TZS 2.65 trillion” in 2025.

– President Samia confirmed that currency depreciation alone added “TZS 3.9 trillion” to the debt stock between 2021–2025.

– Debt Servicing Costs:

– External debt servicing costs surged from “TZS 8.22 trillion (2020/21)” to a projected “TZS 14.20 trillion (2025/26)*”. Depreciation exacerbated this, as repayments required more shillings per dollar.

3. Contradiction in Presidential Claims vs. Reality.

President Samia asserted that the shilling “appreciated annually”, but data reveals:

– Misalignment with Facts:

– While BoT cited a “3.6% annual depreciation”

(contradicting Bloomberg’s 8.9%), even its own data confirms a “net depreciation since 2021”.

– The claim overlooks “structural depreciation pressures”:

Rising imports (+5% to USD 16.9 billion) and infrastructure projects (e.g., USD 42 billion LNG facility) increased dollar demand.

– Debt Growth Drivers Beyond Currency:

1. New Borrowing:

Disbursements from past loan agreements (e.g., “TZS 11.3 trillion” from pre-Samia era loans).

2. Recognition of Hidden Liabilities:

Settlement of “TZS 2.67 trillion” in pension fund debts.

3. Infrastructure Investments:

Projects like the Standard Gauge Railway (USD 7.6 billion) expanded debt.

Table: Exchange Rate Impact on External Debt (2021–2025).

| 1.0 | Year. | Avg. TZS/USD | **External Debt (USD). | Debt in TZS (Trillion). |

| 2.0 | 2021 | 2,298.5. | USD 24.0 billion. | ~55.2. |

| 3.0 | 2025. | 2,650–2,684. | USD 34.1 billion. | ~91.3. |

| 4.0 | Change. | +15.3%. | +42%. | +65%. |

Table: Debt Growth Contributors (2021–2025).

| No. | Factor. | Contribution to Debt Increase. |

| 1.0 | Currency Depreciation. | TZS 3.9 trillion. |

| 2.0 | New Loan Disbursements. | TZS 11.3 trillion. |

| 3.0 | Pension Liabilities. | TZS 2.67 trillion. |

| 4.0 | Infrastructure Projects. | Major (e.g., USD 7.6bn SGR). |

4. Why President Samia’s Stance is Partially Misleading.

– Selective Timeframes:

Highlighting short-term appreciation (late 2024) ignores the **long-term depreciation trend** (2021–2025).

– Debt Ballooning Mechanism:

– Depreciation “magnifies existing USD debts” in shilling terms.

– New borrowing for infrastructure “increases debt stock” regardless of currency performance.

– IMF Assessment:

Tanzania’s debt remains at “moderate risk” of distress, but the “debt-to-GDP ratio rose to 45.5% (2022/23) from 43.6% (2021/22), driven by both borrowing and currency effects.

5. Conclusion: Currency and Debt Dynamics.

The data refutes the claim that the shilling “performed well” under President Samia:

– “Net depreciation since 2021” directly expanded the shilling value of debt by “TZS 3.9 trillion”.

– “New borrowing*?” (for infrastructure and legacy liabilities) and “global factors” (e.g., USD strength) were primary debt drivers.

– Policy Gap:

BoT’s limited interventions (per IMF flexibility rules) failed to counteract structural pressures like import growth and commodity price declines.

Tanzania faces a “dual challenge”:

Managing currency stability through strategic reserves (USD 5.3 billion) while curbing non-concessional borrowing to prevent debt unsustainability.

President Samia’s narrative overlooks the currency’s role in exacerbating debt, emphasizing instead new borrowing for development—a partial but incomplete explanation.

Read more analysis by Rutashubanyuma Nestory