TTCL’s fibreoptic project is in shambles, there is a gulf between promises and delivery of services. What is clear is that the TTCL employees lack incentives to speed up the layout of the fibre optic services courting the ire of the would be internet services while hollowing out company potential profits in the process. I will offer glimpses of the customer frustrations from the TTCL own websites, and investigate the core challenges and how to address them. Here is my take.

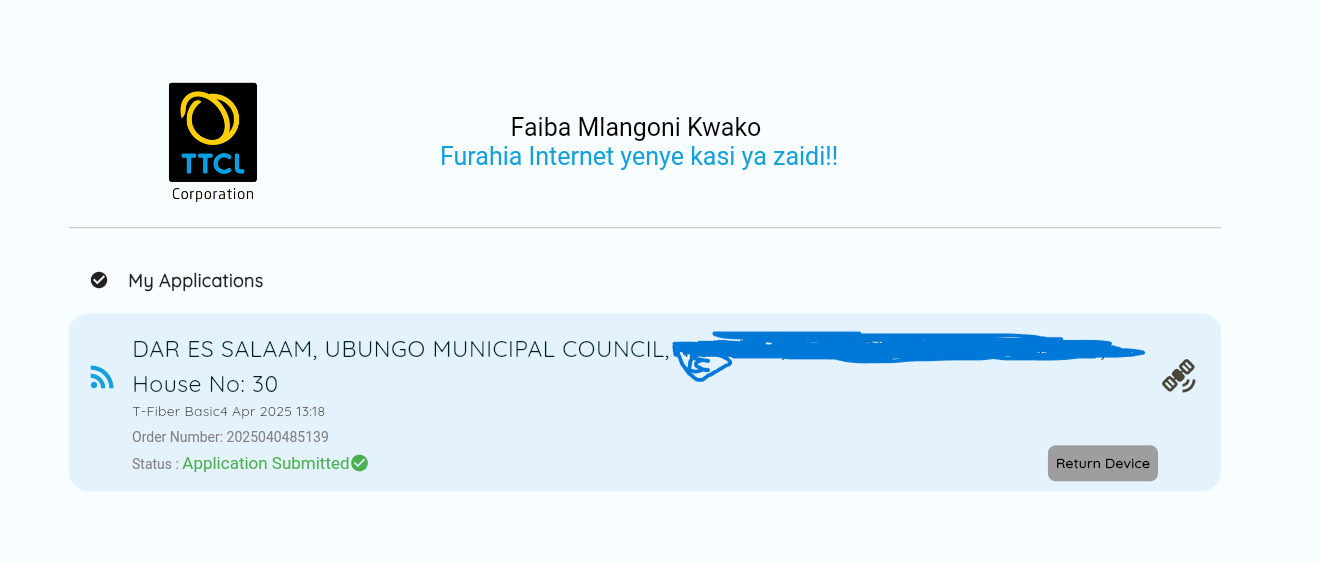

My own investigations captured one on one chats between potential TTCL fibre customers and the TTCL staff is here is what I collated:

From the above communications between potential TTCL fibre optic customers and TTCL staff, you can see that TTCL lacks interest, laziness, and supervision.

TTCL superiors don’t read these messages, and take appropriate actions since they are lowly paid and incentive schemes tied to performance are lacking. As a result, service delivery is inherently poor and no one takes full responsibility. Out of this caboodle, it is TTCL and potential customers bear the full cost. TTCL “fibre mlangoni kwako” has failed to live up to the hype, and is now a pain in the neck of the potential customers.

TTCL has struggled to expand its fiber optics network despite government support due to a combination of strategic missteps, operational inefficiencies, and systemic challenges. Here’s a detailed breakdown of the key reasons:

- Strategic Misalignment and Poor Focus.

TTCL prioritized mobile services (4G) over its core strength in broadband, despite lacking the resources to compete effectively in the saturated mobile market. Analysts and President Samia Suluhu Hassan repeatedly urged TTCL to focus on fixed broadband, where it held a virtual monopoly and owned critical infrastructure like the National ICT Broadband Backbone (NICTBB). Instead, TTCL diverted limited capital to 4G, a market dominated by Vodacom, Airtel, and Tigo, which collectively hold over 80% of the mobile market share.

- Financial Constraints and Underinvestment.

TTCL faced chronic hindering infrastructure upgrades. For instance, it missed its target of 100,000 new broadband subscriptions in Dar es Salaam, achieving only 40,000 due to funding shortages and bureaucratic inertia. Despite government initiatives like the NICTBB (a $260 million fiber-optic project), TTCL underinvested in last-mile connectivity and advanced technologies like GPON, leaving its fiber metro network in Dar es Salaam underutilized.

- Operational Inefficiencies and Bureaucracy.

The company’s operational model was plagued by inefficiencies, such as taking 405 days to resolve customer complaints against a 7-day target .

Political interference exacerbated issues. For example, the Magufuli government staffed TTCL with army officers and mandated it as the sole telecom provider for government institutions, which failed to improve performance, Shielding TTCL from competition resulted into laziness, inefficiencies and ineffectiveness. The

- Competitive Market Dynamics.

Private competitors like Vodacom and Airtel aggressively deployed 4G and fiber networks, while TTCL lagged in adopting modern technologies like LTE and WiMAX.

Mobile substitution eroded TTCL’s customer base, with its mobile market share dropping to 2–3% by 2022.

- Missed Opportunities and Underutilized Assets.

TTCL failed to capitalize on its fiber-optic metro network in Dar es Salaam, which could have provided broadband to affluent neighborhoods and institutions. Instead, it focused on low-return mobile ventures.

While the government expanded the NICTBB to 106 districts (with 33 remaining in 2024), TTCL’s slow execution delayed leveraging this backbone for last-mile connectivity.

- Systemic Issues in State-Owned Enterprises.

TTCL’s struggles reflect broader problems in Tanzania’s state-owned enterprises, including mismanagement, corruption, and lack of accountability. The President criticized TTCL’s inability to implement reforms, noting directives to refocus on broadband were ignored for over a year.

Conclusion.

TTCL’s failure to expand fiber optics stems from a mix of poor strategic choices, financial limitations, bureaucratic inertia, and intense competition. While the government provided infrastructure like the NICTBB, TTCL’s internal inefficiencies and misaligned priorities prevented effective utilization. For future success, experts recommend depoliticizing operations, securing targeted investments, and refocusing exclusively on broadband and wholesale infrastructure services.

What can TTCL do to alleviate her mundane challenges.

Tanzania Telecommunications Company Limited (TTCL) can address its challenges and revitalize its fiber-optic expansion efforts through strategic reforms and leveraging its existing assets. Below are actionable recommendations based on the search results and contextual analysis:

- Prioritize Last-Mile Connectivity and Expand Rural Access.

TTCL has successfully connected 106 districts to the National ICT Broadband Backbone (NICTBB) but needs to focus on last-mile infrastructure to reach end-users, especially in rural areas. Only 40% of Tanzania’s population has internet access, with rural areas lagging due to high deployment costs.

Action:

Accelerate the connection of the remaining 33 districts using allocated 2024/2025 funds.

Innovation:

Deploy hybrid solutions (e.g., fiber + wireless) in remote regions where fiber is impractical. Mobile broadband (3G/4G) can serve as an interim solution until fiber becomes viable.

- Strengthen Public-Private Partnerships (PPPs).

TTCL has already partnered with Vodacom and Huawei to expand infrastructure but needs to scale collaborations.

Lease NICTBB Capacity:

Monetize the government-owned NICTBB by leasing excess capacity to private operators like Vodacom, which signed a $4.59M deal to use the backbone for rural connectivity.

Joint Ventures:

Partner with tech firms (e.g., Huawei) for cost-effective deployments. A recent $15.9M agreement with Huawei extended NICTBB to 23 districts, demonstrating the potential of such partnerships.

- Focus on Wholesale Services and Fiber Monetization.

TTCL’s virtual monopoly on fixed-line infrastructure and ownership of NICTBB positions it as a “carrier of carriers.”

Wholesale Model:

Sell bandwidth to ISPs, mobile operators, and neighboring countries (e.g., DRC via Lake Tanganyika).

Expand Cross-Border Links:

Leverage existing connections to Kenya, Uganda, and Zambia to position Tanzania as a regional hub, attracting international traffic fees .

- Modernize Operations and Technology.

TTCL’s outdated operational models and delayed adoption of advanced technologies have hindered competitiveness.

Adopt GPON/LTE:

Transition to Gigabit Passive Optical Network (GPON) for high-speed fiber-to-home services and expand 4G LTE to complement fixed broadband.

Digital Services:

Scale e-government, e-health, and e-learning platforms via NICTBB to drive demand. TTCL already provides internet at SGR stations and universities.

- Address Financial and Governance Challenges.

Chronic underinvestment and bureaucratic inefficiencies require systemic reforms.

Secure Funding:

Leverage international loans (e.g., China Eximbank’s $70M Phase I loan) and grants (e.g., EU’s $60M for 4G/5G) to upgrade infrastructure.

Depoliticize Management:

Reduce political interference (e.g., past staffing with army officers) and adopt corporate governance models to improve accountability.

- Enhance Customer-Centric Services.

Reduce Complaint Resolution Time:

TTCL currently takes 405 days to resolve issues vs. a 7-day target.